Are Your Financial Statements Meeting Stakeholder Expectations?

Here in San Diego, we’re surrounded by fresh opportunities and remarkable economic potential, such as record levels of venture capital and advances in manufacturing and innovation (San Diego Regional EDC, 2025). Yet even in such a dynamic environment, small business owners are navigating challenges like tax complexity, which is now recognized as a top concern for businesses nationwide (NSBA, 2025).

That’s why clear, reliable financial statements aren’t just paperwork; they’re a strategic tool for building trust with banks, investors, and partners. You deserve reporting that instills confidence and meets stakeholder expectations.

In this blog, I’ll show you what today’s funders and business partners are looking for when they review your numbers. We’ll highlight common reporting gaps that could be holding your business back. Finally, I’ll help you decide whether an audit, review, or compilation is the best way to help your business stand out and grow with confidence.

What Stakeholders Really Want from Your Financial Statements

When you send financials to a lender, investor, or business partner, they aren’t just looking for profits; they’re looking for clarity, confidence, and credibility. A well-prepared statement doesn’t just show numbers; it shows you run a diligent, trustworthy business.

According to the American Institute of Certified Public Accountants (AICPA), outside parties often look for clear assurance that your statements are free of significant errors and that a knowledgeable professional has reviewed them. I see this in practice every day, when your financial statements are accurate, organized, and easy to understand, it’s much easier to unlock new funding or partnership opportunities. In an uncertain world, financial transparency builds the trust that keeps your business moving forward.

Case in Point:

Not long ago, I worked with a San Diego manufacturer who needed financing to expand its operations. After I prepared a clear, reviewed financial statement, their lender moved quickly to approve the funding. Having well-prepared, professional financials didn’t just check a box, it gave their banker the confidence to say yes.

Choosing the Right Fit: Compilation, Review, or Audit

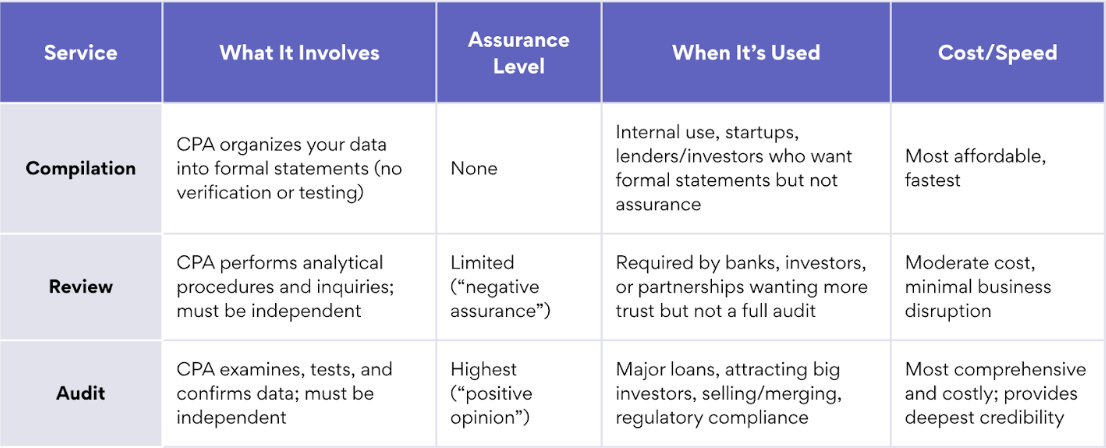

It’s normal to feel unsure about which financial statement service is best. Here’s the simple truth: your choice depends on your goals, your partners, and the level of confidence you need in your numbers.

Compiled Financial Statements:

This is the most basic option. I take your financial data and organize it into formal statements, like a balance sheet or income statement. There’s no verification or testing, so it’s quick and affordable, but offers no assurance. It’s perfect for internal use, early-stage businesses, or smaller loans where lenders just want to see your numbers in a standard format.

Review:

A review adds credibility if you need more than a compilation. I’ll ask targeted questions and analyze your financials for anything out of the ordinary, providing “limited assurance” that nothing looks materially wrong. Many banks or partners will request reviewed financial statements for moderate transactions or growing businesses. Reviews strike a balance between trust and cost, and are often required for financing according to AICPA guidelines.

Audit:

An audit is the gold standard. I’ll test records, confirm balances, and thoroughly review your internal processes to make sure your financials are free from significant error. Audits are often needed for larger loans, investments, business sales, or when regulations require it. As firms like Moss Adams and PKF San Diego note, audits are frequently the “credibility badge” that can lower your financing costs and give major stakeholders confidence to move forward.

Which is right for you?

It depends on your growth stage and what your stakeholders ask for. Most businesses start with compilations, progress to reviews as they grow, and audit only when necessary. I’ll help you find the right fit, no more, no less.

When a Compilation is the Right Fit

If you want professional statements, quickly and without deep digging or high cost, a compilation fits the bill.

When might you need a compilation?

Applying for a modest loan or line of credit.

Budgeting, planning, or reporting to your board.

Meeting basic compliance when no audit is needed.

The AICPA and industry leaders agree: it’s common to start with compilations when you have limited accounting resources or when external parties want financial statements but don’t require assurance.

I format your statements, check for obvious errors, and keep everything by the book—no verification, just clear, organized financials. Each page is marked “Unaudited, see Compilation Report,” so everyone knows what’s been done.

When a Review is the Right Move

If you want more than organized numbers (but don’t need a full audit), a review is your best bet.

Think of it as a checkup for your financials. I’ll review your statements, compare trends, and ask questions to make sure everything adds up. You (and your stakeholders) get “limited assurance”—enough confidence for moderate loans, partner agreements, or when your business is growing.

According to the AICPA, reviews are a practical, budget-friendly way to show you take financial accuracy seriously, and lenders often require them for moderate financing or as a next step in business growth.

When an Audit Is Worth It

Sometimes, you need certainty. That’s when an audit is essential.

I go deep into your records, test key transactions, and review your controls to make sure your statements reflect your accurate financial picture. Audits show investors, lenders, and buyers that you’re serious about transparency—perfect for major deals, business sales, or when required by regulations or your board.

Firms like Moss Adams and PKF San Diego point out that an audit is often the marker of credibility that unlocks bigger funding and opportunities. While audits can seem daunting, my approach is thorough yet supportive. I’m here to validate your hard work and give you the confidence you need to move forward.

Taking the Stress Out of Financial Statements

Financial statements can feel overwhelming in an unpredictable world. According to the NSBA’s 2025 Small Business Economic Report, nearly two-thirds of small business owners say economic uncertainty is their single most significant challenge. You may worry about deadlines, disruptions, or meeting everyone’s expectations. You’re not alone.

My goal is to make things as smooth and reassuring as possible. I’ll work with you to minimize disruptions, offer honest guidance, and keep you confident from start to finish. Well-prepared financials aren’t just about compliance—they’re your key to stress-free growth and new opportunities.

Why Work With Geri Wood?

Often, my clients want more than just numbers on a page. They’re looking for clear answers, dependable support, and a relationship built on trust.

Personalized service: You work directly with me—not shuffled between departments.

Clarity over complexity: I’ll explain your options in plain English, so you can make confident decisions.

Local insight, big-firm expertise: I know California and Southwest business practices and bring national-level skill to your engagement.

Modern, secure process: My technology keeps your data safe and the process smooth, with many steps handled remotely.

Honest advice: I recommend only what you genuinely need, helping you avoid unnecessary costs.

Many clients tell me they dreaded the idea of an audit or review, until it became a positive turning point for their business. My promise: you get both expertise and care so that you can grow with confidence.

“Geri and her team made what I thought would be a stressful audit surprisingly easy. They explained everything, found simple ways to fix our reporting, and helped us secure financing for our expansion.”

— San Diego Manufacturer

Your Partner in Financial Clarity and Growth

Clear, professional financial statements are more than a compliance task—they unlock opportunities, build trust, and give you peace of mind. Whether you need a straightforward compilation, a thoughtful review, or a thorough audit, I’m here to walk with you every step of the way.

You’ll always get personal attention, transparent guidance, and solutions tailored to your unique situation. If you still have questions about which service is right for you, visit our Frequently Asked Questions for more clarity before you get started.

Ready to feel confident in your finances?

[Learn more about financial statement audit services]

[Contact me to schedule a personalized consultation]