How to Stay Compliant: Employee Benefit Plan Audit Requirements for 2026

2026 Is a Turning Point for Employee Benefit Plan Audits in California

In Southern California, a well-executed employee benefit plan audit has become essential insurance for your company’s future. 2026 brings new rules that every thoughtful business leader should have on their radar. New DOL and IRS rules, stricter audit thresholds, and increased enforcement have made audit compliance a must-have for the health of your plan and your business's reputation.

Why Staying Ahead of 401(k) Audit Requirements Matters

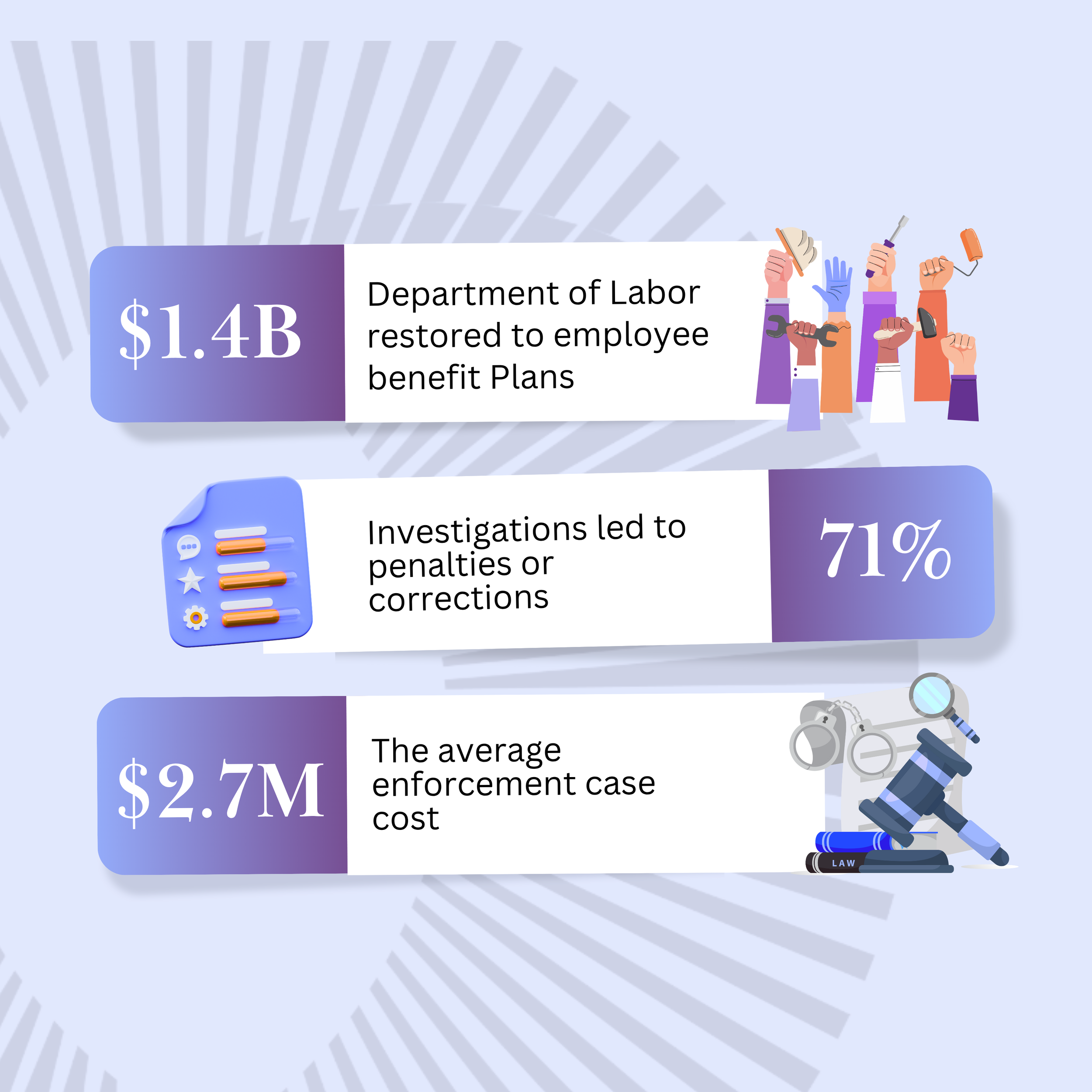

The DOL restored more than $1.4 billion to plans in 2024, with 71% of investigations leading to corrective action (averaging $2.7 million per employer). Noncompliance risks loss of funding, fines, and personal fiduciary liability, but smart leaders see a chance to turn compliance into a strength.

Who Is Subject to the 2026 Employee Benefit Plan Audit Requirement?

Employee benefit plan audit requirements aren’t one-size-fits-all. In 2026, it’s more important than ever to know whether your organization is required to complete an audit, and what exactly triggers that obligation.

Decoding the 100-Participant Rule

Starting with 2023 plan years (applicable for 2026 filings), the Department of Labor clarified that only participants with account balances on the first day of the plan year are counted toward the “100-participant” audit threshold. This means a company with 120 eligible employees but only 75 with balances may now be exempt. In contrast, a business that’s grown rapidly in SoCal tech or manufacturing could unexpectedly tip over the audit line.

Common Pitfalls: Overlooking Former and Part-Time Employees

Many HR and finance leaders overlook that even terminated or part-time employees with balances still count toward the audit trigger. According to recent data, 30% of mid-sized Southern California employers had to make plan corrections in 2023 after miscounting eligible participants. Missing this detail can result in missed audit deadlines, unnecessary penalties, or even a loss of compliance status.

Regularly review your plan’s participant roster and consult with your San Diego 401 (k) auditor or employee benefit plan audit services partner to ensure compliance with evolving 401 (k) audit requirements.

Deadlines, Documentation & the Form 5500

Audit documentation must be pristine:

File Form 5500 within seven months of plan year-end (typically July 31).

2026 forms demand more data, especially for pooled and auto-enrolled plans.

Mistakes or late filings are top targets for the DOL.

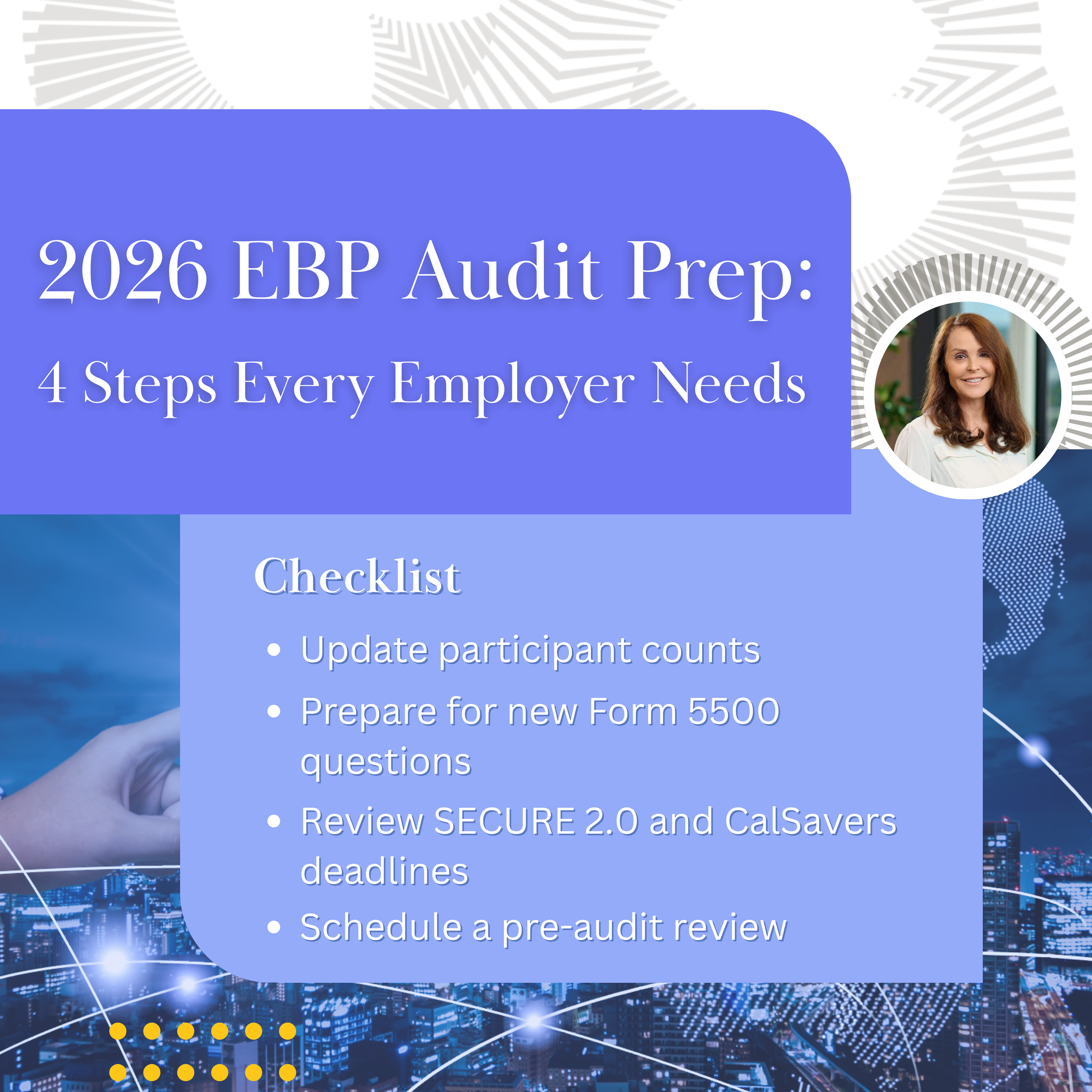

Checklist:

Collect all plan documents, amendments, and summary descriptions.

Prepare participant census data and payroll records.

Pre-schedule a mock audit or pre-review.

Use digital calendars and automated reminders.

Firms using secure portals and digital tools reduce stress and stay audit-ready.

What Happens if You Miss Your 2026 Employee Benefit Plan Audit?

Failing to complete your required employee benefit plan audit or making preventable mistakes can result in more than just paperwork headaches. The risks are real and can escalate quickly for Southern California employers.

Common DOL and IRS Penalties for Missed or Inadequate Audits

In 2024, the DOL imposed penalties that reached up to $2,700 per day for missing or incomplete audits and filings. Local cases have involved significant repayments; one Los Angeles manufacturer faced $600,000 in late contribution corrections after a DOL investigation. Ignoring audit requirements or falling behind on Form 5500 deadlines is among the fastest routes to costly enforcement action.

Actual Cost: Why Quality Audit and Assurance Services Save Money

Relying on generalized accounting firms or inexperienced auditors often leads to missed compliance details and expensive after-the-fact corrections. Statistically, audit providers specializing in employee benefit plan audit services, with ERISA and 401 (k) audit expertise, demonstrate fewer errors, lower deficiency rates, and ultimately lower long-term costs. Proactively engaging a trusted San Diego 401 (k) auditor provides peace of mind and tangible protection for your plan, your participants, and your leadership team.

The Most Common Errors in Auditing Employee Benefit Plans

Even well-intentioned plan sponsors and administrators can fall into traps that put compliance, efficiency, and fiduciary standing at risk.

Industry-Specific Risks for SoCal: Tech, Nonprofit, and Manufacturing

Tech: Fast growth often causes companies to surpass the audit threshold without realizing it. High turnover and dispersed workforces can lead to miscounted or lost participant balances.

Nonprofits: Resource limitations and legacy contracts can cause documentation gaps or missed plan amendments.

Manufacturing: Complex eligibility (union vs. non-union), bonus calculations, and late employee deferrals are familiar sources of error.

What the AICPA Employee Benefit Plan Audit Quality Center Looks For

The AICPA Employee Benefit Plan Audit Quality Center has flagged that late 401 (k) deposits, inaccurate census data, and missed SECURE 2.0-related plan amendments are among the most frequent errors in 2024 and 2025 reviews. The data is precise:

Accurate compliance requires both sector expertise and up-to-date knowledge of employee benefit plan audit requirements.

Tip: Annual compliance training, a dedicated audit checklist, and partnering with a specialized San Diego 401 (k) auditor are your best defenses against costly mistakes.

How to Prepare: Steps for a Successful 2026 Audit

A smooth, successful audit begins long before your auditor arrives. Smart SoCal businesses now rely on a robust employee benefit plan audit checklist, supported by technology and expert local partners.

Choosing the Right San Diego 401 (k) Auditor

Selecting an auditor who specializes in employee benefit plan audit services is critical. Research shows that audit providers completing 25 or more EBP audits annually have far fewer deficiencies. Seek out a San Diego 401 (k) auditor with ERISA, 401 (k) audit services, and regional industry experience. This is especially important for plans affected by rapid headcount changes, complex payroll, or unique benefit structures.

Set up a compliance calendar: Digital reminders for all deadlines.

Conduct a mock audit to identify and fix issues preemptively.

Organize documentation: Store digitally in a secure portal.

Annual training: Keeps HR and finance ahead of changes.

Use technology: AI-enabled HRIS/payroll tools reduce human error.

Consider reading my blog, Why San Diego Businesses Can’t Overlook Employee Benefit Plan Audits.

Key Compliance Updates for 2026

The 2026 compliance landscape is shifting, especially for Southern California employers in tech, manufacturing, and healthcare. Here are some of the key compliance updates to be aware of for 2026:

Active balance rule: Only current account balances count for the audit threshold.

Expanded Form 5500: More participant data, new enforcement focus.

SECURE 2.0: Watch for mandatory amendments and auto-enrollment requirements.

CalSavers: Fines for noncompliance, even for small businesses.

Top-performing organizations leverage audit and assurance services for employee benefit plans and digital compliance platforms, ensuring efficiency and error-free operations.

Secure Compliance with Expert Employee Benefit Plan Audit Services

Proactive preparation is the key to staying compliant and protecting your business as the 2026 employee benefit plan audit requirements evolve. By tracking participant counts, staying current with Form 5500 updates, and choosing specialized audit and assurance services for employee benefit plans, you’ll safeguard your people and your organization.

Schedule a Consultation with an Employee Benefit Plan Auditor

Don’t wait until you’re under deadline pressure.

Schedule a consultation with a San Diego 401 (k) auditor to ensure your plan is ready, your risks are minimized, and your leadership team can focus on growth, not regulatory headaches. Want to make sure you’re prepared for a conversation with an auditor? Download my guide 10 Questions to Ask a Financial Statement Auditor.