Quality of Earnings

See the True Value of Your Business—

Before Anyone Else Does

Whether you’re selling your company or considering an acquisition, a Quality of Earnings report equips you with the insights you need to make confident, well-informed decisions.

Actionable financial insights that help you sell, raise capital, and negotiate with confidence.

The #1 Reason Sales and Investments Fall Apart? Overlooked Financial Red Flags

Did you know that 48% of mid-market business deals are delayed or repriced because of financial issues uncovered late in the process? It’s not just about numbers on a spreadsheet; it’s about deal momentum, credibility, and real money at stake.

Buyers, lenders, and investors now demand a level of financial transparency that goes far beyond the basics. They want assurance that your earnings are sustainable, your cash flow is solid, and that no hidden risks are lurking beneath the surface.

Suppose you haven’t prepared the right due diligence documents, or you’re relying on standard reports alone. In that case, you’re putting your business at risk of last-minute surprises, tough negotiations, and lost opportunities. Many business owners in your position don’t realize the real story in their numbers until someone else points it out, when it’s too late to fix.

Don’t let a hidden issue, one-off event, or unclear earnings story derail your next big move. The risk? Lost trust, lost momentum, and potentially millions left on the table.

Why Sellers and Buyers Need a Quality of Earnings Report

For Sellers

Identify and resolve financial “red flags” before going to market.

Maximize deal value by presenting sustainable, credible earnings.

Gain control over the sale process and reduce the risk of last-minute price cuts or broken deals.

For Buyers

Make confident decisions with clear, unbiased analysis.

Validate the accuracy and sustainability of the seller’s reported earnings.

Uncover hidden risks, aggressive accounting, or unsustainable growth before closing.

Avoid overpaying for inflated earnings.

The Smartest Move Before Every Sale or Capital Raise

With an independent quality of earnings report, you walk into every negotiation prepared. Our deep-dive financial analysis uncovers risks and clarifies your actual earnings before a buyer or lender ever points them out.

By proactively revealing and addressing red flags, you avoid the costly surprises that derail nearly half of all sales and investments. Get ahead of the process; our trusted, third-party assurance puts you in control and helps you protect your bottom line.

How Our Quality of Earnings Process Keeps Deals on Track

We make getting a Quality of Earnings

report simple and stress-free

Step 1

Discovery Call: Share your goals and concerns—we’ll explain exactly what you need for a successful transaction.

Step 2

Document Collection: We guide you through assembling the necessary due diligence documents and financial data, ensuring nothing is overlooked.

Step 3

Comprehensive Analysis: Our team dives deep into your numbers, uncovering hidden risks and highlighting your business’s strengths.

Step 4

Clear, Action-Ready Report: Receive an independent report, written in plain language, that prepares you to answer any buyer or lender questions with confidence.

With our process, you get bank-ready analysis—delivered quickly, with no last-minute surprises.

How Our Quality of Earnings Report

Builds Trust—and Value

Don’t just take our word for it—see what business owners and buyers say about the impact of an excellent quality of earnings analysis:

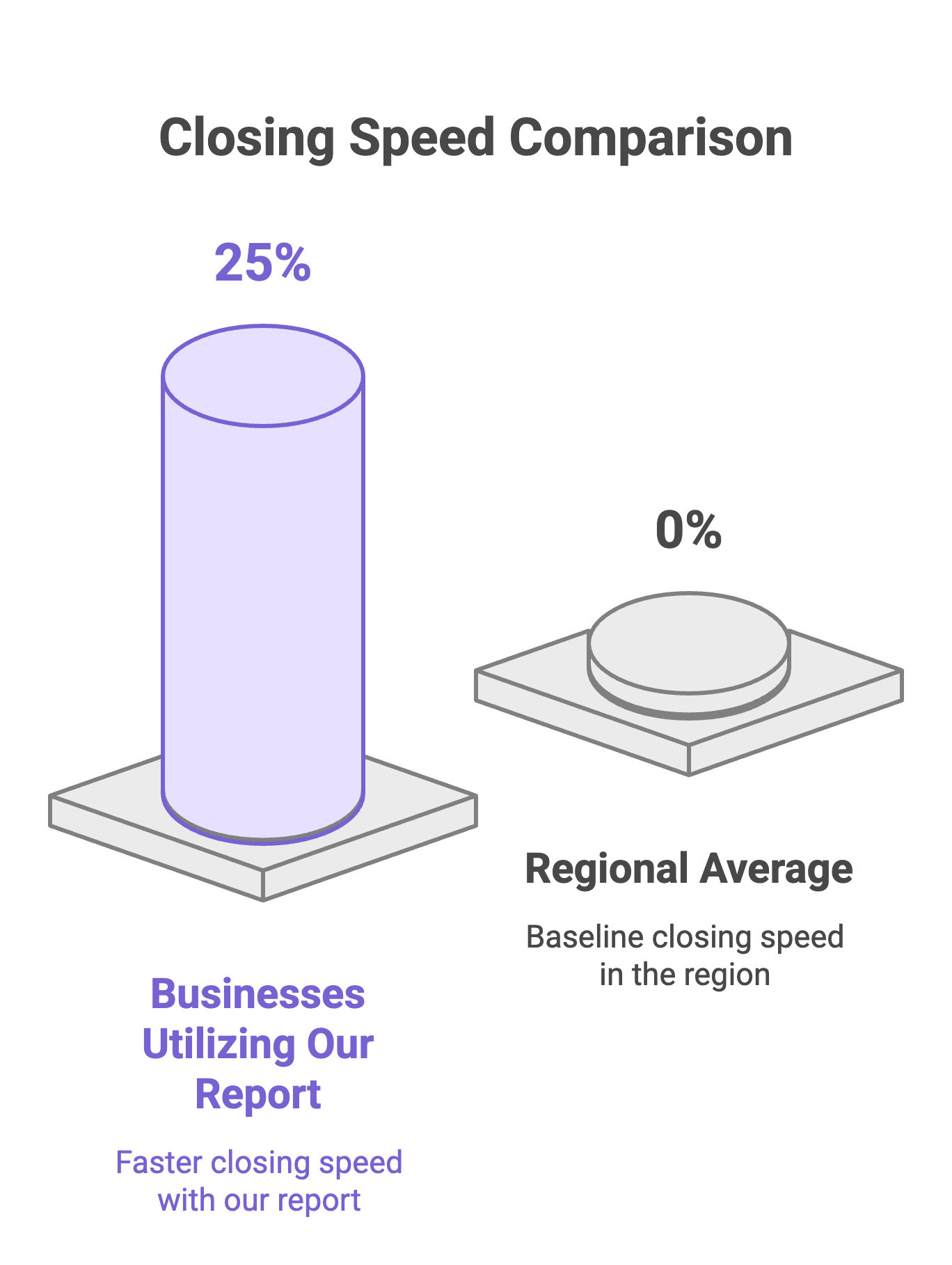

Businesses using our quality of earnings report close 25% faster than the regional average.

95% of our clients report smoother, more successful negotiations after investing in our quality of earnings analysis.

Trusted By:

We’re trusted by business owners, buyers, lenders, and investors who demand thorough, third-party quality assurance for their most important transactions.

Don’t Wait for Surprises—

Get a Trusted Quality of Earnings Analysis Now

Let’s make your next deal your strongest yet. With our independent quality of earnings report, you’ll have the confidence, clarity, and negotiating power to move forward—no surprises, no setbacks.

Quality of Earnings vs. a Financial Audit

Primary Focus

Looks At

Key Output

Who Uses It

Historical Accuracy & GAAP Compliance

Past Only

Audit Opinion

Regulators, Lenders, Owners

Economic Reality & Ongoing Earning Power

Past & Future Potential

Actionable Insights, Adjusted EBITDA, Risks & Opportunities

Buyers, Sellers, Investors, Boards

A financial audit is designed to verify historical financial statements for accuracy and compliance with accounting standards (GAAP), providing assurance that the records are correct as of a certain date.

In contrast, a Quality of Earnings analysis goes deeper and looks forward. It analyzes the underlying sustainability and reliability of the company’s earnings, identifies any one-time or non-operating items, and pinpoints risks or opportunities that could impact future value.

Even companies with audited financials can benefit from a QoE, as it offers insights that standard audits often miss—such as aggressive accounting tactics, unsustainable earnings, or potential operational weaknesses.

Financial Audit

Quality of Earnings Report

Frequently Asked Questions About Quality of Earnings Reports

-

A quality of earnings report is an independent, detailed analysis of a company’s earnings and cash flow, focusing on their accuracy, sustainability, and reliability. In mergers and acquisitions (M&A), it helps buyers and sellers uncover hidden risks, defend business value, and avoid surprises that could disrupt deals or reduce the sale price.

-

A typical quality of earnings report sample will cover adjusted EBITDA, revenue quality, working capital analysis, cash flow breakdowns, non-recurring or one-time events, and risk factors. The report translates complex financial data into clear, actionable insights—so you know exactly what drives your business’s true earning power.

-

Quality of earnings reports are commonly used in the sale or acquisition of a business, securing investment, refinancing, and preparing for audits. They give all parties a clear view of financial health, supporting negotiations and satisfying lender or investor requirements.

-

The quality of earnings ratio measures the proportion of income generated from core, recurring operations versus one-time or non-operating sources. A strong ratio builds buyer and lender confidence, increasing your business’s credibility and often its valuation.

-

Look for a CPA-led team with experience in your industry, a track record of successful M&A transactions, and an independent approach. The right advisor will provide clear reports, communicate in plain language, and offer hands-on support throughout the process.

-

Quality of earnings analysis is a key part of M&A due diligence because it uncovers the real risks and opportunities in a business’s financials. It helps all parties make informed decisions, negotiate better terms, and avoid post-deal disputes or renegotiations.

-

Your due diligence checklist should include up-to-date financial statements, tax returns, customer and supplier contracts, debt agreements, payroll records, and any supporting documents relevant to your revenue and expenses. A thorough checklist ensures a smooth, transparent sale process.